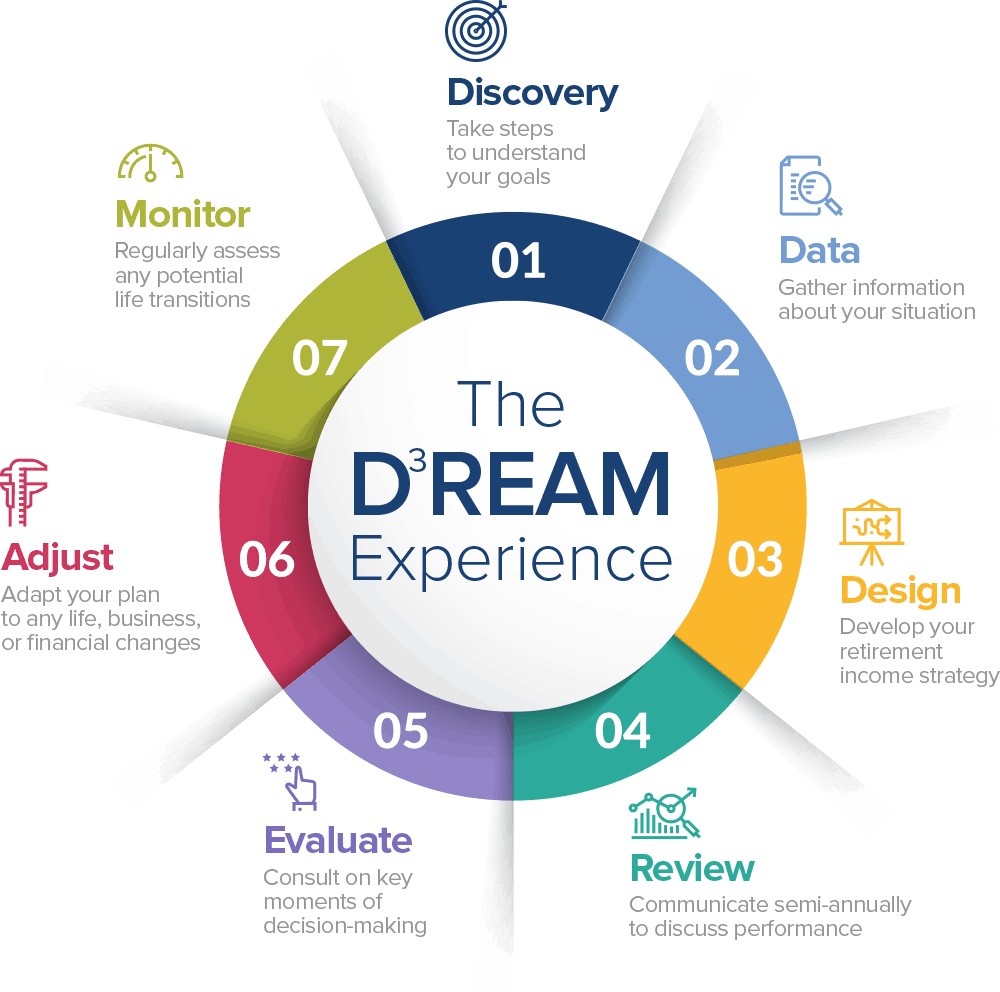

The D3ream Experience

A cornerstone to any quality financial plan is a proven process. Our D3REAM Experience is tailored to meet your unique needs and help accomplish your personal goals. Our team of fiduciary advisors continually utilizes this process to thoughtfully listen, effectively collaborate, and continually partner with you as your life goes on.

The only inevitability with any financial plan is change. The D3REAM Experience not only creates a customized financial plan for you today, but helps provide for the eventualities in the future.

THE D3REAM EXPERIENCE

Discovery

Take steps to understand your goals. Your advisor will take the time to get to know you and your unique situation. You won’t be working with someone who only sees you as a number – your advisor will understand what makes you tick and what freedom looks like for you.

THE D3REAM EXPERIENCE

Data

Gather information about your situation. A comprehensive look at your life and finances will help reveal where your priorities are and what changes can be made to get you closer to your version of freedom.

THE D3REAM EXPERIENCE

Design

Develop your retirement income strategy. After understanding every financial and non-financial asset in your life, we create a personalized wealth plan – a plan that’ll serve as the road map toward your goals.

THE D3REAM EXPERIENCE

Review

Communicate semi-annually to discuss performance. Once your wealth plan is in motion, we reach out to check in on your goals, evaluate your plan, and make sure your money is working in your best interest. Having a plan is a start – but we help ensure that the plan is in motion and stays in motion.

THE D3REAM EXPERIENCE

Evaluate

Consult on key moments of decision making. You can be as involved in your wealth plan as you’d like thanks to the Client Experience. The portal lets you access all your accounts in one place, so you can easily view your plan and track your progress.

THE D3REAM EXPERIENCE

Monitor

As your advisory team it’s our job to constantly ensure that you’re progressing towards your goals. We’re actively engaged in monitoring both your investments and your risk (insurance) planning to make sure you’re on track to meet your goal, while making any adaptations as changes to the tax code come.