The Federal Reserve announced last week it would reduce its bond purchases faster than expected and signaled it intended to raise interest rates up to three times next year. The purchases were being reduced by $15 billion per month and will now accelerate to $30 billion per month, and the program to support the economy will end in March. One Fed governor announced a rate increase is possible for March.

Key Points for the Week

- The Fed announced a hawkish policy shift as its inflation outlook increased, doubling the pace of reduction in bond purchases to $30 billion per

- Fed projections now show three 0.25% rate hikes in 2022.

- Retail sales eased and missed projections but turned in the fourth consecutive monthly increase, primarily driven by fuel and food as families gathered for Thanksgiving.

A survey of key Fed governors and officials now shows all officials expect at least one hike next year and the majority expect three hikes. Eight Fed meetings are scheduled in 2022, and it is unlikely the Fed will raise rates more than 0.25% each meeting or raise rates two meetings in a row.

U.S. retail sales rose just 0.3% in November. Strong October data indicated some Christmas shopping was moved up one month. For example, Black Friday sales posted their first ever decline compared to the prior year.

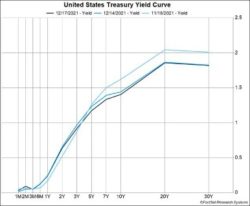

Stocks fell under the pressure of higher rates and the rapidly spreading Omicron variant. The S&P 500 index declined 1.9% after reaching an all-time record the previous week. The MSCI ACWI sagged 1.5%. The Bloomberg U.S. Aggregate Bond Index added 0.4% as bonds reacted positively to a more hawkish Fed (Figure 1). Data releases will be relatively light in a holiday-shortened trading week. PCE inflation and personal income lead a short list of key data releases this week.

Figure 1

Pushing the Brakes Harder

The Fed isn’t just tapping the brakes. Lingering inflationary pressures have worked their way further into the economy, and the Federal Reserve is seeking to slow the economy down in order to reduce those pressures. The Fed lowered rates during the onset of the pandemic to help lower the cost of debt, making it cheaper to borrow and increasing economic investment and the purchase of large consumer items, such as homes and cars.

Combined with direct aid from the government, these efforts helped the economy to bounce back from COVID-19, and unemployment has fallen close to the Fed’s long-term expectations. Increased purchases, combined with fewer people working, has created supply snags and shortages. Companies have responded by raising prices in order to balance supply and demand, thereby increasing inflation.

In response to the recent jump in inflation, the FOMC announced at its meeting last week that it would increase the speed of its tapering. Previously, the Fed said it would reduce purchases by $15 billion/month until it was no longer buying bonds, which would have put it on pace to end the program by June. The announcement last week doubled the speed of the reduction to $30 billion/month, which would end it three months sooner, in March. This, in turn, would open the door for the Fed to begin raising short-term interest rates sooner than what was expected earlier this year. In fact, in only the past six months, expectations went from zero to three rate hikes in 2022.

What caused such a massive shift in policy? In the summer, it looked like inflation in the U.S. was starting to ease. However, inflation re-accelerated in the second half of the year, mostly due to further supply chain challenges from the continuing COVID pandemic and storms that affected many parts of the country. The Fed believes inflation in the U.S. may persist longer than expected, especially with the likelihood that the new Omicron variant may add to this year’s challenges. Also, while the U.S. labor market has not fully recovered it remains very strong, with the unemployment rate just 0.2% above the Fed’s own estimate of long-run unemployment.

The good news is the markets, particularly the bond market, took the news in stride. If anything, the Fed moved closer in its policy to what the market was expecting. There was a small uptick in short-term rates, but long-term rates actually fell over the course of the week as the market recognized the shift made sense: Given inflation, employment, and growth expectations, the Fed should remove its accommodations faster than initially planned to ensure higher levels of inflation do not become entrenched (Figure 1).

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://news.yahoo.com/fed-waller-says-rate-hike-180000609.html

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20211215.pdf

https://marketnews.com/fomc-publishes-2022-meeting-schedule

https://www.federalreserve.gov/monetarypolicy/openmarket.htm

Compliance Case # 01218940