In the midst of a banking crisis that has seen some of the largest U.S. banks collapse nearly overnight and 100-year-old European banks verging on failure, not to mention a volatile bond market and a plunge in crude oil — the Federal Reserve raised rates. While we’d expect stocks to tumble in the face of such headwinds, it hasn’t happened.

- The headlines have been bad; yet, stocks have gained over the past two weeks.

- Sentiment has returned to being very negative, which is typically a contrarian sign.

- The Federal Reserve raised the federal funds rate by 0.25% at its March meeting.

- However, Fed members did not signal many more rate increases as they expect credit conditions to tighten.

- Fed members also don’t expect to cut rates this year as inflation remains elevated; that differs greatly from market expectations.

In fact, the S&P 500 has officially gained over the past two weeks despite the banking drama. How could this be? There are certainly more questions than answers right now, and yes, the odds of a recession have increased as banks will tighten lending, which could lead to an economic slowdown. Still, economic data is improving. Housing data is rallying, manufacturing is showing signs of a low, and the consumer is demonstrating incredible resilience.

One of the best reasons to be bullish is very few people are. Recent sentiment polls show a high number of bears while worries about the economy and earnings continue to expand. Why is this a good thing? Think back to March 2003, March 2009, and March 2020. Those were all scary times; yet, stocks made major lows in those years. In 2003, the war in Iraq started after a three-year bear market; the global financial crisis was underway in 2009 and stocks dropped by half; and in 2020 the world shut down due to COVID-19. None of these periods felt like good times to look to a brighter future, but they were.

When investors are bearish, few sellers remain. That means any good news could spark a rally. Potential sparks this time: an increase in FDIC insurance; a Fed that is nearly done hiking; inflation continuing to come back to Earth; stronger earnings from corporate America; a consumer that continues to drive the economy; and the recent banking crisis not expanding past a few badly positioned banks.

Although it might not feel like it, there are many reasons to expect stocks to bounce back and markets to improve.

Banking Stress to Substitute for Rate Hikes

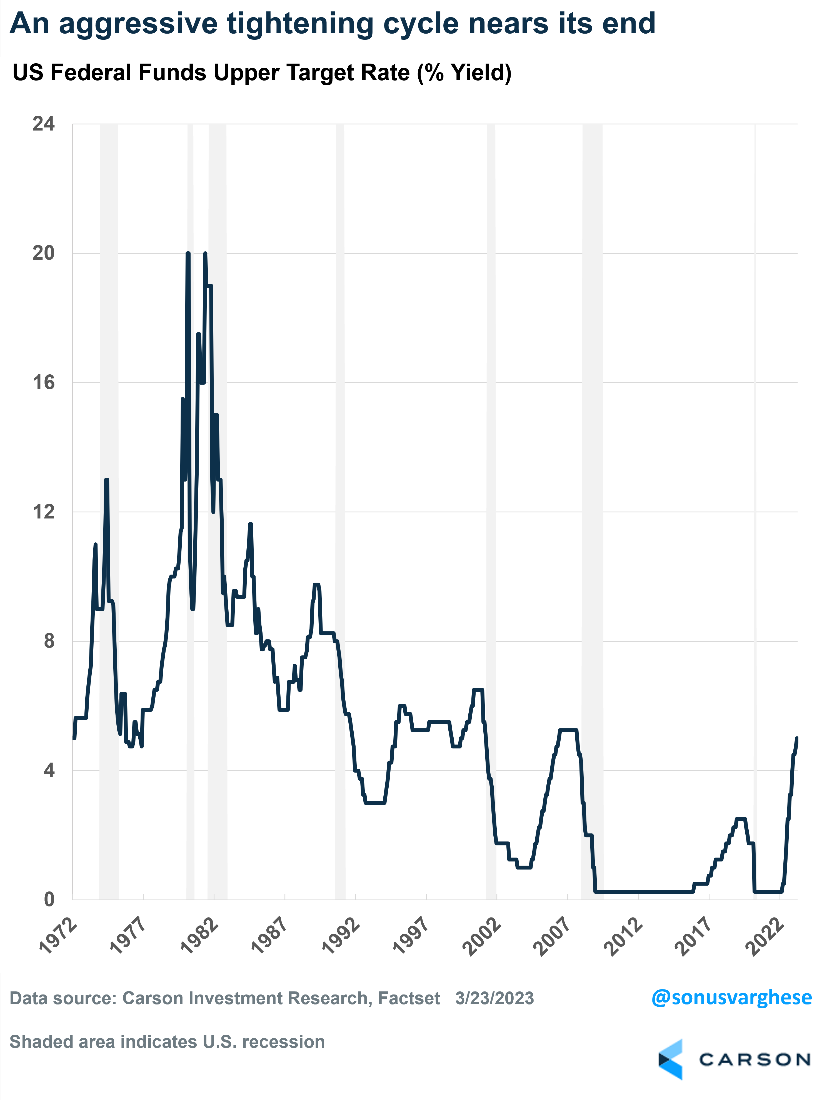

The Federal Reserve raised the federal funds rate by 0.25% at its March meeting, bringing it to the 4.75-5.0% range. This is the ninth straight rate increase and brings rates to their highest level since 2007. However, the most aggressive tightening cycle since the early 1980s, during which the Fed lifted rates from near zero to almost 5%, is near its end.

Up until early February, Fed officials expected to raise rates to a maximum of about 5.1% and hold them there for a while. However, since that time a slew of strong economic data, including elevated inflation numbers, came in. This pushed Fed officials to give “guidance” that they expected to raise rates by more than they estimated in December.

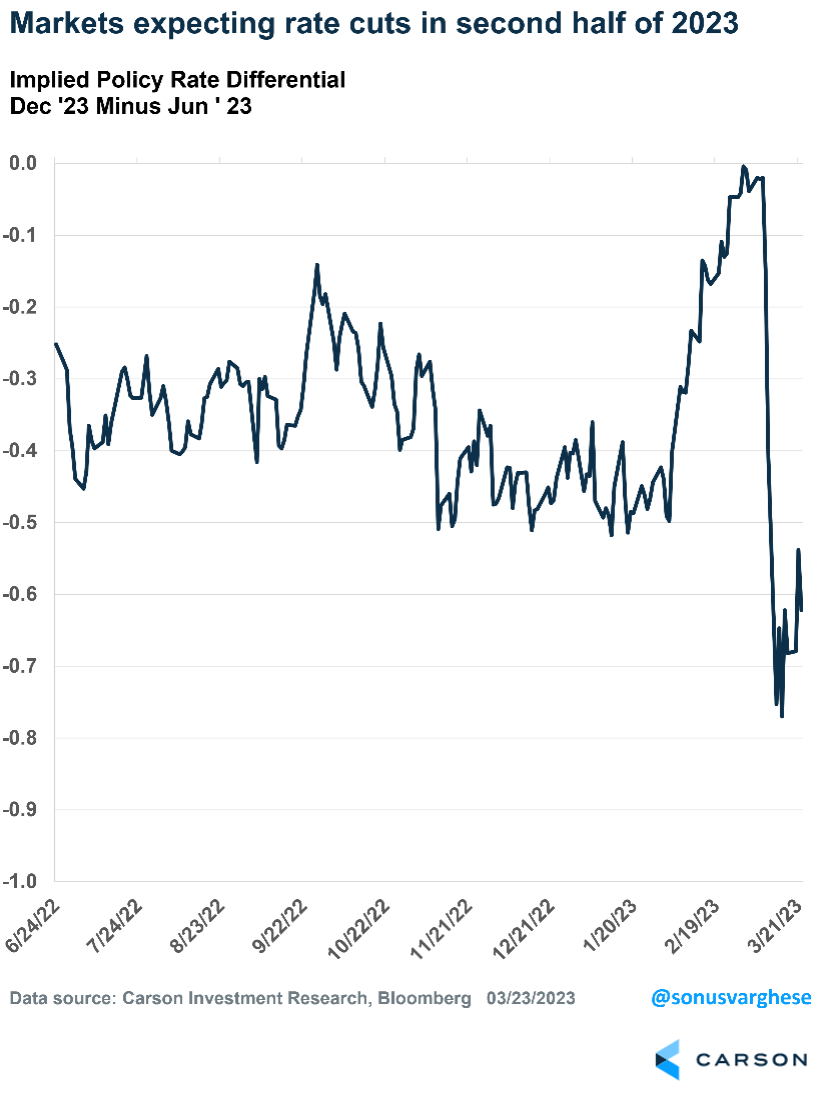

Market expectations for policy moved accordingly. Prior to February, markets expected the Fed to raise rates to 5% by June and subsequently lower them by about 0.5% by the end of the year. But strong incoming data and Fed guidance pushed expectations higher, with the terminal rate moving up to 5.6% and no cuts in 2023.

The Silicon Valley Bank Crisis Changed Everything

The bank crisis that erupted over the last couple of weeks resulted in a significant shift, both in expectations for policy and the Fed’s actions. See here for our complete rundown on SVB and the ensuing crisis.

Market expectations for Fed policy rates immediately moved lower. Markets expected the stress in banks to translate to tighter credit conditions, which in turn would lead to slower economic growth and lower inflation.

This was nicely articulated by Professor Jeremey Siegel, one of the foremost commentators on financial markets and Fed policy, in our latest episode of the Facts vs Feelings podcast. Prof. Siegel said that tighter credit conditions, as lending standards become more strict, are de facto rate hikes.

Fed Chair Jerome Powell spoke similarly after the Fed’s March meeting. The 0.25% increase was an attempt to thread the needle between financial stability and fighting inflation. Fed officials also forecast the fed funds rate to hit a maximum of 5.1%, unchanged from their December estimate. This is a marked shift from what was expected just a few weeks ago, with Powell explicitly saying that tighter credit conditions “substitute” for rate hikes.

Uncertainty Ahead

While the recent bank stresses are expected to tighten credit conditions, and thereby impact economic growth and inflation, a couple questions remain:

- How big will the impact be?

- How long will the impact last?

These are unknown currently, which means future policy is also unknown.

Fed officials expect to take rates to 5.1%, i.e., one more rate increase. And they expect to hold it there through the end of the year. In short, they don’t expect rate cuts this year.

Yet, investors expect no more rate increases and about 0.6% of rate cuts in the second half of 2023. Markets expect the policy rate in June to be at 4.8%, while expectations for December are at 4.2%.

There’s clearly a huge gulf between what the Fed expects and what investors expect. This will have to reconcile in one of two ways:

- Market expectations move higher — if economic/inflation data remain strong and credit conditions don’t tighten significantly.

- Fed expectations move lower — if the banking sector comes under renewed stress, credit conditions tighten significantly and eventually lead to weaker data.

Events will not unfold in a straight line. It’s going to be a bumpy ride as new data points come in, not to mention news and rumors of renewed problems in the banking sector.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

A diversified portfolio does not assure a profit or protect against loss in a declining market.

Compliance Case # 01705649