We’ll get to the disappointing inflation data next, but Thursday morning had a pure panic feel to it — potentially the washout that is needed for lows to form.

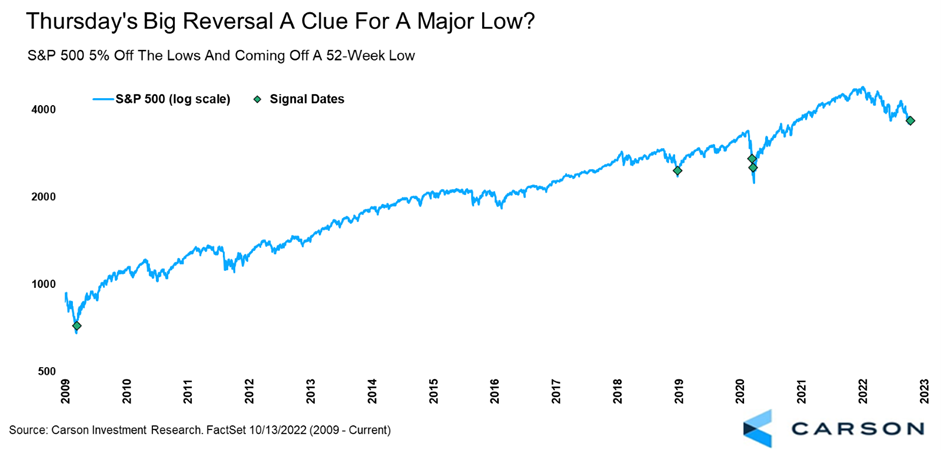

The Consumer Price Index (CPI) came in hotter than expected and stocks sold off very hard, this on the heels of a down market six days in a row. Then, a funny thing happened. The S&P 500 closed more than 5% off the lows, a very rare sign and one that has taken place at major lows in the past. In recent market history, the S&P 500 closed more than 5% off the lows, while also coming off a 52-week low, in March 2009, December 2018, and March 2020. With the obvious benefit of hindsight, all those points marked a market bottom and signaled future strength.

The big picture: The S&P 500 retraced 50% of the entire bull market near the 3,500 level, exactly the point where buyers aggressively stepped in to find bargains. A closer look reveals another positive development. Even as the S&P 500 made new lows, fewer stocks made new lows. Nearly 200 stocks made a new 52-week low on June 16 (during the summer lows); yet, fewer than 100 stocks made new lows last week. This is what past lows have shown, suggesting more strength under the surface that could spark a rally.

October is known as a bear market killer, with many bears ending during this month, most famously in 1974 and 2002. With overall market sentiment flashing some of the most fear we’ve ever seen, we are optimistic that 2022 could indeed join that list of bears to end in October.

Lastly, third quarter earnings season has officially started, and although it is quite early some initial results have been impressive, likely adding confidence for investors. We’ll provide more earnings updates over the coming weeks.

Key Points for the Week:

- More clues point to a potential major low.

- Market internals show positive developments, similar to other major lows.

- Earnings season is very early but off to a solid start.

- Inflation remains stubbornly high, but there are some positive signs.

- The Federal Reserve has plenty of room to remain aggressive in raising rates, at least until signs indicate inflation is reversing in a meaningful way.

Inflation Remains an Issue

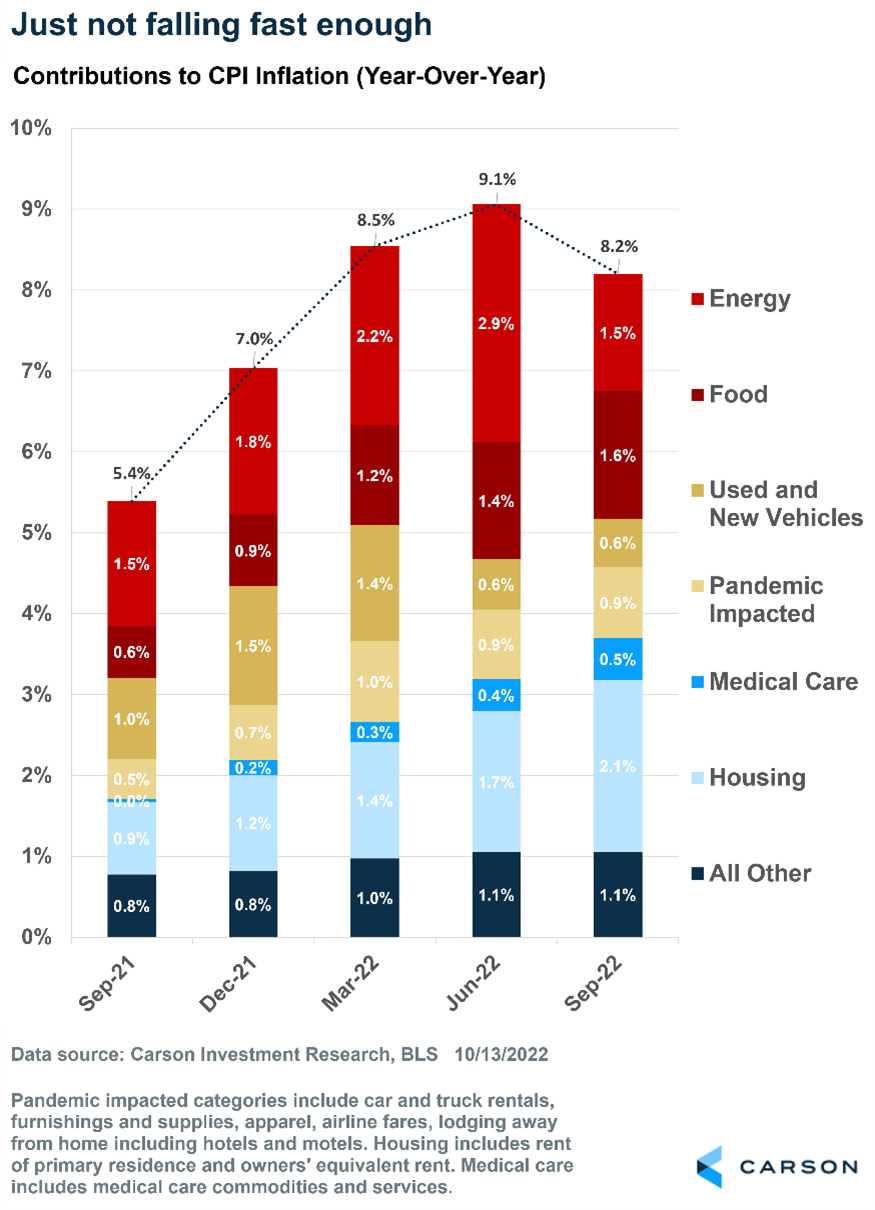

Another inflation report offered more signs that inflation remains stubbornly high. The September Consumer Price Index (CPI) rose 0.4% month-over-month, well above the 0.2% that was expected and above the previous month’s 0.1%. The year-over-year number was 8.2%, down slightly from the previous month’s 8.3%. Meanwhile, core CPI (excluding food and energy) soared a huge 0.6% versus 0.4% expected. The year-over-year increase was 6.7%, up from 6.3% in August.

Starting with some bright spots (and we use that lightly), goods categories continued to slow, with energy down 2.1%. But that wasn’t as much as the previous two months’ drops of 4.6% and 5.0%. Used car prices fell 1.1% but not as much as expected. Similar to other reports, private surveys of used car prices have dropped much more than what the government is reporting. Lastly, apparel prices sank 0.3%, but this also wasn’t as large a drop as expected. The good news is goods prices are starting to fall. The bad news is they are not falling enough to offset price increases in services.

Overall year-over-year inflation is now just below where it was in March, but the biggest drivers have shifted from commodities, supply-chain, and pandemic-impacted sectors to services.

Shelter costs were among the most significant reasons for higher services inflation, along with medical care and medical and vehicle insurance. Services ex-energy were up 0.8%, the largest increase in 40 years.

Shelter makes up about 40% of the core inflation basket, so when it runs hot it’s a big deal. It held steady at 0.7% month-over-month, while owners’ equivalent rent was up 0.7% month-over-month, the highest since July 1990. Of course, shelter makes up only about 17% in the core PCE deflator (the Fed’s favorite measure of inflation), so it shouldn’t have nearly as much impact when that important data is released.

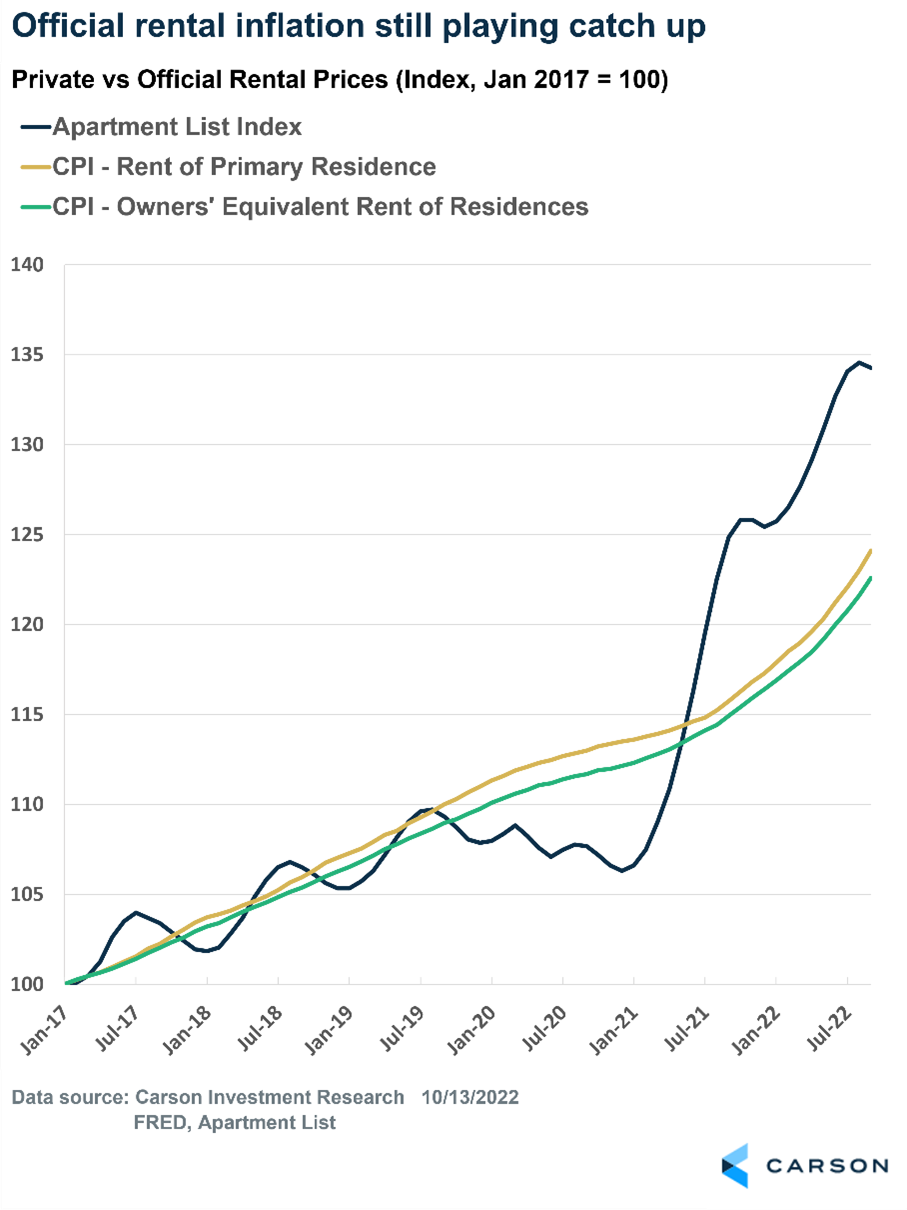

Rental prices jumped 7.2% over the past year, the largest annual increase since 1982. Rents climbed 0.8% month-over-month, after a string of 0.6% to 0.7% prints. The catch is some private measures of rents have slowed considerably, with the Apartment List national rent report showing a 0.2% drop in prices in September for the first time this year.

How can there be such a different view on rents? The government looks at both existing and new leases, while private indices consider just new leases. For the official data, rental units are sampled only every six months (rents aren’t renegotiated very often). For this reason, we expect CPI rental measurements to lag private indices by about 8-12 months.

Other positives include data from Zillow, which showed rent prices rose 0.3% in September versus a 1.6% gain in September last year, and a report from Realtor.com, which showed nationwide median rental prices in 50 large metro areas grew at the slowest pace in 16 months in September. Again, this differs from government data.

In the services sector, medical care services jumped 1.0% month-over-month, for the largest jump since February 1984. Much of the increase came from a 2.1% jump in health insurance, which has risen a stunning 28.2% over the past year — a rise that is primary due to methodology. CPI captures health care prices by reviewing the change in profit margins at health insurers. It is only done once a year, around September/October, so the data has a massive lag and October should mark the start of a large drop that continues over the coming months.

Airline fares jumped 0.8% month-over-month, which is somewhat surprising given the drop in fuel prices. But if you’ve flown lately, then you know most flights are indeed totally full.

What Does it all Mean for Markets?

For starters, it gives the Federal Reserve plenty of room to continue its aggressive rate hiking regime. It essentially cemented a third consecutive 75 basis point hike in November, with federal funds futures raising the probability of that occurring to 97% from 81% before the inflation report was released. But the bigger problem is the likelihood of another 75 basis point hike in December moved up from 33% to 62%.

We remain optimistic that inflation, especially core inflation, has peaked and should start to fall faster. Time to delivery, prices paid, most commodities, rents, used cars, and shipping costs all suggest the supply chain/higher prices are indeed improving. That means the Fed may start to ease up after December. We’ll be the first to admit that inflation has stayed higher than we expected, but all hope isn’t lost.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

Compliance Case #01519430